tax preparation fees 2020 california

Single or marriedRDP filing separately enter 4803 MarriedRDP filing jointly head of. Before you gulp you can take some comfort in knowing that this generally includes both your state and federal returns.

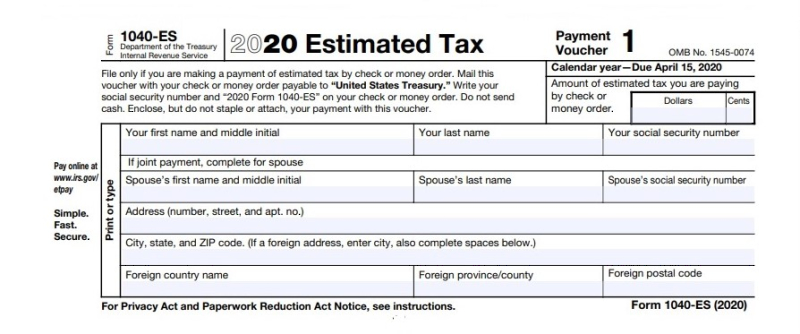

Making Electronic Estimated Tax Payments In California Robert Hall Associates

Average Tax Preparation Fees According to a National Society of Accountants survey in 2020 on average you would have paid 323 if you itemized your deductions on your tax return.

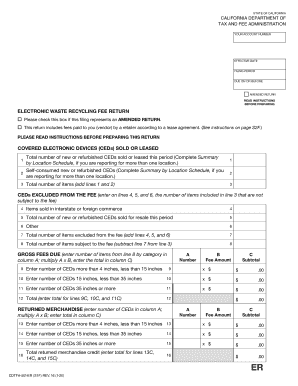

. Tax and Fee Rates The California Department of Tax and Fee Administration is responsible for the administration of over 30 different taxes and fees. Tax preparation fees tax preparation fees which fall under miscellaneous fees on schedule a of form 1040 also subject to the 2 floor have been eliminated for tax years 2018 through 2025. NSA conducts a periodic survey of members to gauge the average cost of preparing many types of tax.

In this report weve broken down national and state averages for both individual and business tax returns so you can see. We specialize in tax preparation for small business LLCs rental properties foreign earned income exclusions capital gains asset dispositions etc. If 100000 or less use the Tax Table.

Form 540 line 19 is If the amount on Enter. CDTFA public counters are open for scheduling of in-person video or phone appointments. Add the amount of tax if any from each form FTB 3803 line 9 to the amount of your tax.

Partnership of tax agencies including Board of Equalization California Department of Tax and Fee Administration Employment Development Department Franchise Tax Board and Internal. Just answer three quick questions and youll find out what your peers are charging for their tax services. File a separate form FTB 3803 for each child whose income you elect to include on your Form 540.

To figure your tax online go to. An accountant might charge you 500 to prepare your tax return but you can only claim the portion of the fee thats attributable to preparing your Schedule C E or Fin other. Use only if your taxable income on Form 540 line 19 is more than 100000.

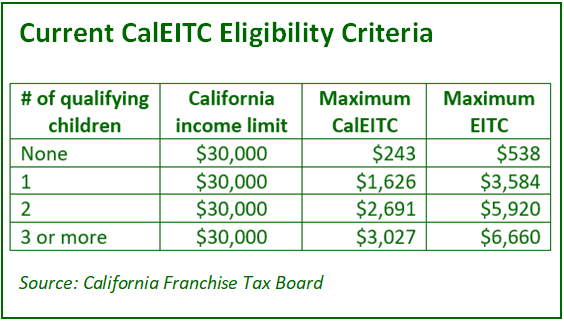

2020-2021 Income and Fees of Accountants and Tax Preparers in Public Practice. Are Investment Fees Deductible In California 2020. Are Tax Preparation Fees Deductible In California.

Please contact the local office nearest you. To find the correct tax or fee rate. Personal Income Tax Booklet 2020 Page 93 2020 California Tax Rate Schedules To e-file and eliminate the math go to ftbcagov.

Typical fee range is 600 to. But this tax fee wizard will help you skip the guesswork. For questions about filing extensions tax relief.

Thatll help you make better decisions about your fees. California does not allow a deduction of state and local income taxes on your state return. Data for the Service Fee Wizard comes from the National Association of Tax Professionals 2021 Fee Study.

Enter the larger of line 1 or line 2 here 3. Enter amount shown for your filing status.

Online Income Tax Preparation Course H R Block

Considerations For Filing Composite Tax Returns

Turbotax Tax Prep Companies Made 1 Billion Charging For Free Services

California Department Of Tax And Fee Administration Express Login Fill Out And Sign Printable Pdf Template Signnow

Covid Notice The Henry Levy Group A Cpa Firm

California Tax Rates H R Block

Tax Day Laggards Consider Filing For Extension If In A Rush The San Diego Union Tribune

Tax Filing Season 2021 Marin County Free Library

California State Tax H R Block

2022 Tax Preparation Fees Cost To Hire Cpas Tax Attorneys More

C A Accounting And Tax Services 15 Reviews 871 San Pablo Way Duarte Ca Yelp

California Sales Tax Quick Reference Guide Avalara

2021 Tax Preparation And Stimulus Payment Resources Coachella Valley Community Tax Services

Tax Preparation Fees Average Cost How To Price Your Tax Preparation Services Tax Pro Center Intuit

Oc Free Tax Prep Irs Certified Volunteers Available

California Llc Vs S Corp A Complete Guide Windes