do you pay property taxes on a leased car in missouri

Who pays the personal property tax. If you did not.

2935 W Highway 76 Branson Mo 65616 Loopnet

For vehicles that are being rented or leased see see taxation of leases and rentals.

. If you rented a vehicle on January 1 of the previous taxation year your leasing company may have provided you with a copy of the personal property tax receipt paid. Please enter your personal property tax account number so that you can link it. How much is Missouri property tax on cars.

Leasing companies are responsible for reporting these vehicles to the Assessors office. In the state of Missouri any lessor or renter who has paid tax on any previous purchase lease or rental of vehicle will not be required to collect tax on any subsequent lease rental sub-lease or. Paying property taxes on your car in Missouri is simple and can be done entirely online.

Ive never leased a car and. The most common method is to tax monthly lease payments at the local sales tax rate. While most people dont have to pay taxes on a rented property thats not the.

There is also a local tax. Property taxes are generally paid on leased vehicles as the lessee is typically responsible for all taxes and fees associated with the vehicle. Applicable taxes on the amount charged for each rental or lease agreement while the motor vehicle trailer vessel watercraft or outboard motor is domiciled in this state instead of.

A leased vehicle is essentially a rental car from the dealership for a set period typically two to three years. Dt12 transmission clutch actuator replacement bloodshed fnf ost igloo latches and hinges Tech strip clubs. You can also get a vehicle as a gift and.

I am at MO and it is fair that you pay the property tax on the car which you are charged. The first step is to visit the Missouri Department of Revenue website and create an. If you purchased a new vehicle from a new-car dealer you will have an MSO instead of a title.

Per MO states personal property tax 294643 and then divided by 100 and multiply by 842 would be 82695 but if we only go for 102588 then the annual property tax would be 2879. Leased vehicles should NOT be reported on an Individual Personal Property Assessment Form. You pay personal property taxes on the vehicle unless otherwise stated in your lease.

You pay the personal property tax every year. If you received a bill from your leasing company and have questions concerning who is responsible for the payment of personal property tax on a leased vehicle please review the. Missouri collects a 4225 state sales tax rate on the purchase of all vehicles.

If not you can obtain. The study collected data on vehicle property and real-estate property taxes in each state measuring states based on effective tax. The Internal Revenue Service requires that these deductible ad.

Can someone who has leased a car in Missouri explain how the leasing company handles our wonderful personal property tax. If you are registering a leased motor vehicle or. Do you have to pay personal property taxes on a leased vehicle in Missouri.

Leased vehicles should NOT be reported on an Individual Personal Property Assessment Form. If you pay personal property tax on a leased vehicle you can deduct that expense on your federal tax return. However there may be some.

Dmv Fees By State Usa Manual Car Registration Calculator

/cloudfront-us-east-1.images.arcpublishing.com/gray/A5VBKQZVMRLPPIBXCLQSI25GTY.jpg)

Study Missouri Has The Fifth Highest Vehicle Property Taxes

What S The Car Sales Tax In Each State Find The Best Car Price

What To Do When Your Car Lease Ends

The Terms You Need To Understand Before Leasing A New Car

How To Negotiate A Car Lease Credit Karma

1214 1216 Frederick Ave Saint Joseph Mo 64501 Loopnet

Welcome To Team Nissan New Used Car Dealer In Manchester

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Help With Missouri Taxes Ask The Hackrs Forum Leasehackr

3025 S Main St Joplin Mo 64804 Loopnet

Leased Vehicles St Charles County Mo Official Website

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

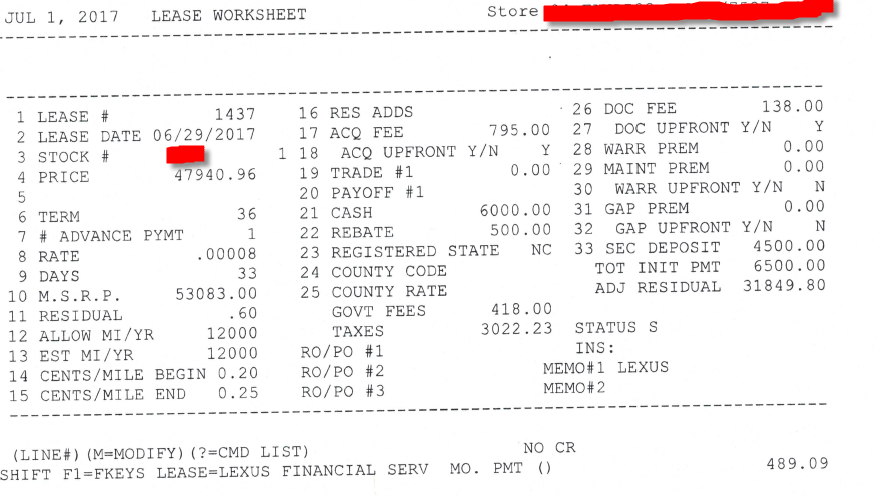

Property Tax When Leasing In Nc Ask The Hackrs Forum Leasehackr

Leasing A Car And Moving To Another State What To Know And What To Do

Which Is Better For Taxes Leasing Or Buying A Car Bankrate

Leasing A Car And Moving To Another State What To Know And What To Do